Craig Johnson

Public Records That Can Harm Your Credit Score

Any public record on your credit report is a mark against you, but some are worse than others.

The three major credit reporting companies—TransUnion, Experian, and Equifax—use public records. Public records are the data and documents filed by federal, state, and county government. They are visible to the public by default. Keeping records public has the protection of the First Amendment because knowing the workings of their judicial system is in the interest of all citizens.

Creditors prefer to see no public records on a person's credit report; in other words, there's no such thing as a public record that helps someone's report. To varying degrees, they are always negative.

Search Anyone FreeA few examples of public records are foreclosures, bankruptcies, wage garnishments, court judgments, tax liens, and past-due child support. These records show up in background searches, such as those performed at PeopleWhiz, and can also appear on a person's credit report. But not all records, and not forever.

So which public records can appear on your credit report, and how much do they affect your credit score?

Public Records That Appear on Your Credit Report

Credit reports don't show all public records. Births, deaths, and divorces are examples of public records that never appear on a credit report. In general, if the record doesn't stem from a debt, it won't be reported to the credit bureaus.

When it comes to the public records that do appear on a credit report, some are worse than others. Most remain on a credit report for seven years, others for 10. Some become a permanent feature on a person's in-depth credit profile.

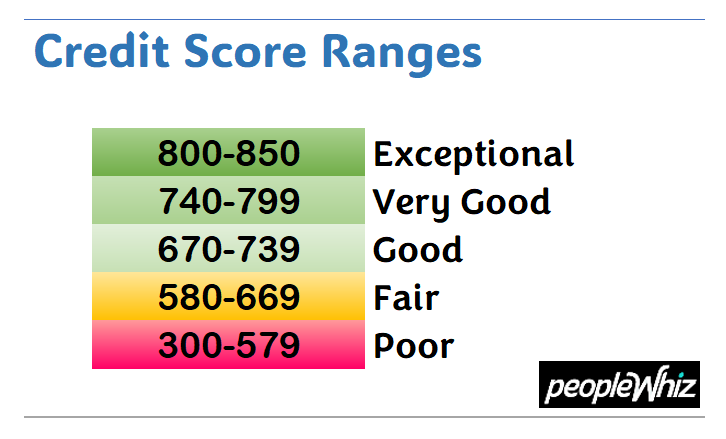

Bankruptcy. On a credit report for 10 years or more. As for the impact of bankruptcy on credit score, attorney Russ Cope writes: "For a person with a credit score of 680, filing for bankruptcy will lower your score by 130-150 points. For a person with a score of 780, filing for bankruptcy will cost you 220-240 points." Bankruptcy hurts higher scores more than lower scores.

Tax lien. Paid tax liens stay on a credit report seven years (in California, 10 years). Unpaid tax liens can stay on a report 15 years or forever.

Foreclosure or repossession. Seven years from the date of first delinquency. A foreclosure lowers a credit score by 85 to 160 points according to CNN Money.

Wage garnishment. Seven years, with the affect diminishing over time. FICO does not reveal its scoring methods, but anecdotal reports suggest that the drop in a person's credit score can be as little as 6 points or as much as 150.

Past-due child support. Up to seven years. A child support enforcement agency may agree not to file a report with the credit reporting companies if you pay some or all of the overdue support.

Your credit score may predict how long you’ll be married. A Federal Reserve study concluded that the closer the two partners’ credit scores are at the start of the relationship, the more likely they are to stay together.

Source: Federal Reserve

Civil Judgements

A creditor can take a seriously delinquent customer to court, and the result is a civil (noncriminal) judgement. These judgments could be for such debts as the wage garnishments and past-due child support mentioned above or for defaulted student loans and auto loans, and miscellaneous debts. The court decides how much the customer must pay to satisfy the debt.

A judgement remains on a credit report for seven to 10 years from the filing date, no matter if it gets paid before the end of that time.

Judgements affect your credit score the most during the first two years. During this time, the only loans you would qualify for are those with high interest rates and fees, and you'd need to come up with a big down payment too.

Do whatever you can to avoid a judgement, because they have a bad influence on your credit score for a long time. Your payment habits account for almost 35 percent of your credit score. Paying debts on time is the best single thing you can do for your credit score and to avoid any eventual court judgement.

The Good News

A public record may appear on your credit report totally by mistake. One out of five consumers had an error on at least one of their credit reports, according to a 2012 study by the Federal Trade Commission, and that error got removed after it was disputed.

Mistakes happen often enough that the three credit reporting companies strengthened the requirements for public records to appear on their reports. For example, liens and civil judgements must now include your name, address, and either social security number or date of birth.

Even better, the requirements are retroactive. The credit reporting bureaus are purging any public record that lacks all of the above information. They are also removing medical collection accounts that insurance companies are handling or have handled.

Despite what credit repair companies claim, it's nearly impossible to get legitimate public records stricken from your credit report. By all means, dispute any errors you find on your credit report, but don't believe any company that says it can get factual records removed.

Takeaways

- Public records on your credit report are never a good thing.

- Most records stay on your credit report seven years.

- Erroneous public records can be removed from your credit report.